special tax notice 401k rollover

That means the Notice. Ad Open an IRA Explore Roth vs.

Reporting 401k Rollover Into Ira H R Block

If you do not roll.

. Our solutions are customized to meet the needs of your complex and diverse workforce. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA. Traditional or Rollover Your 401k With T.

Order to roll over the entire payment in a 60-day rollover you must use other funds to make up for the 20 withheld. Funds to make up for the 20 withheld. Gauge your retirement readiness and see where you stand today.

In this case if you roll over 10000 to an IRA in a 60-day rollover no amount is taxable because the 2000 amount not rolled over is treated as being. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. Get answers from a knowledgeable advisor today.

Special rule may apply to determine whether the after-tax contributions are included in the payment. Ad Learn more about IRAs and the possible tax benefits of rolling over your 401k. This notice explains how you can continue to defer federal income tax on your retirement savings in your companys 401 k.

Order to roll over the entire payment in a 60-day rollover you must use other funds to make up for the 20 withheld. Our solutions are customized to meet the needs of your complex and diverse workforce. IRS Model Special Tax Notice Regarding Plan Payments.

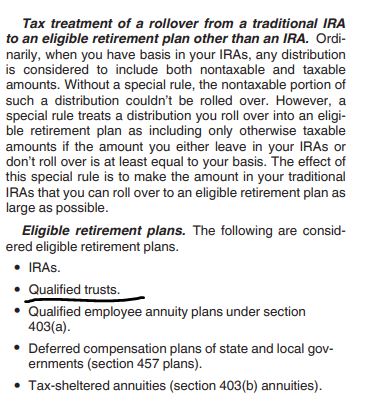

You may roll over your after-tax contributions to an IRA either directly or indirectly. Open An IRA Today. In addition special rules apply when you do a rollover as described below.

In order to roll over the entire payment in a 60-day rollover you must use other funds to make up for the 20 withheld. Ad Understand Your Options - See When And How To Rollover Your 401k. A Team Of Experienced Consultants Can Help You At Every Step.

If you do not roll over the entire amount of the payment the portion not. Order to roll over the entire payment in a 60day rollover you must use other - funds to make up for the 20 withheld. In this case if you roll over 10000 to an IRA in a 60-day rollover no amount is taxable because the 2000 amount not rolled over is treated as being after-tax contributions.

This notice describes the rollover rules that apply to payments from the Plan that are not from a. After-tax Contributions and Roth 401k plan deferrals1 After-taxrollover into an IRA. Explore The Advantages of Moving an IRA to Fidelity.

Ad Gain Access to a Wide Range of Investment Options When you Transfer To a Fidelity IRA. 2000 is after-tax contributions. Ad Open A Roth Or Traditional IRA W TIAA To Take Advantage Of Retirement Savings.

Get Started Today and Build Your Future At A Firm With 85 Years Of Retirement Experience. No Upfront Fees No Risk. Also participants can only do an indirect 401 k plan rollover once in a 12-month period.

Schwab Has 247 Professional Guidance. This notice is intended to help you decide whether to do such a rollover. The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover.

SPECIAL TAX NOTICE REGARDING YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Retirement Systems of. You may roll over. If they do this again before a year has elapsed the entire balance of the second rollover.

If you do not roll over the entire amount of the payment the portion not. If you have a 500000 portfolio download your free copy of this guide now. However if you receive the payment before age 59 12 you also may have to pay an additional 10 tax.

Ad See how we help employees maximize the value of the benefits and compensation you offer. In this case if you roll over 10000 to an IRA that is not a Roth IRA in a 60-day rollover no amount is taxable because the 2000 amount not rolled over is treated as being after-tax. It Is Easy To Get Started.

PUBLIC EMPLOYEE RETIREMENT ADMINISTRATION COMMISSION. You may be able to use special tax rules that could reduce the tax that you owe. If you do not roll over the entire amount of the payment the portion not.

Ad See how we help employees maximize the value of the benefits and compensation you offer. If you do not roll over the entire amount of the payment the portion not. Fidelity Investments - Retirement Plans Investing Brokerage Wealth.

TPAs serving 401 k plans may want to remind their clients that they should review and update their special tax notices in the wake of changes to. Special Tax Notice Regarding Your Rollover Options. Ad Form 5500 IRA 401k Expert Business Valuation 3 days.

Do We Have To Provide New Paperwork When A Participant Requests A Second Distribution

401k Rollover Series How Do I Rollover My 401 K Into An Ira

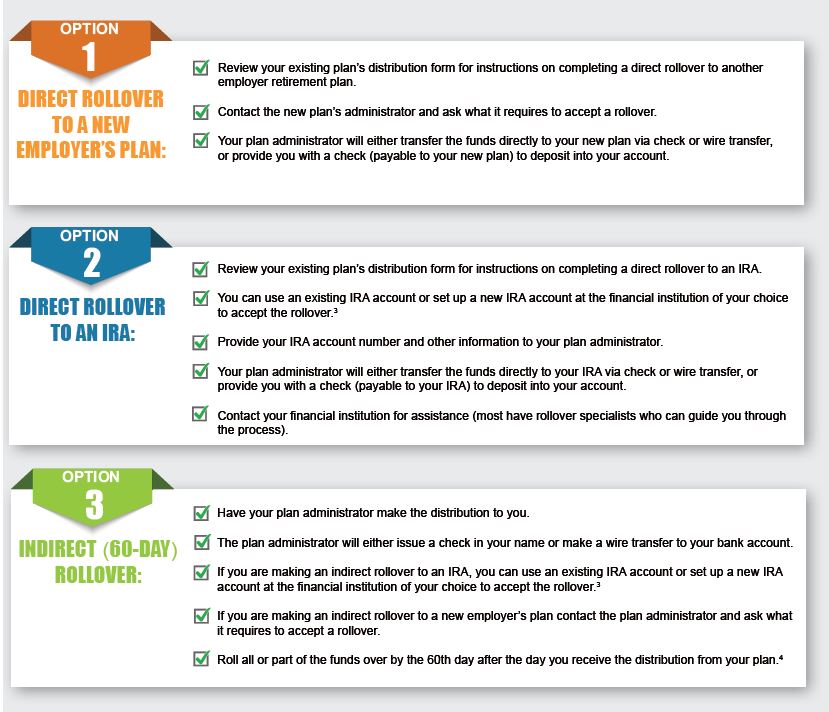

401 K Rollovers What Are My Options John Hancock

Reg Bi S 401 K Rollover Obligations Wolters Kluwer

Solo 401k Faqs My Solo 401k Financial

The Right Way To Roll Over Your 401 K And Ira Money Marketwatch

Roll Over Your Employer Retirement Plan Assets First Bank

Solid Discover The Possibilities Retirement Plan Rollover Guide Helps You Pdf Free Download

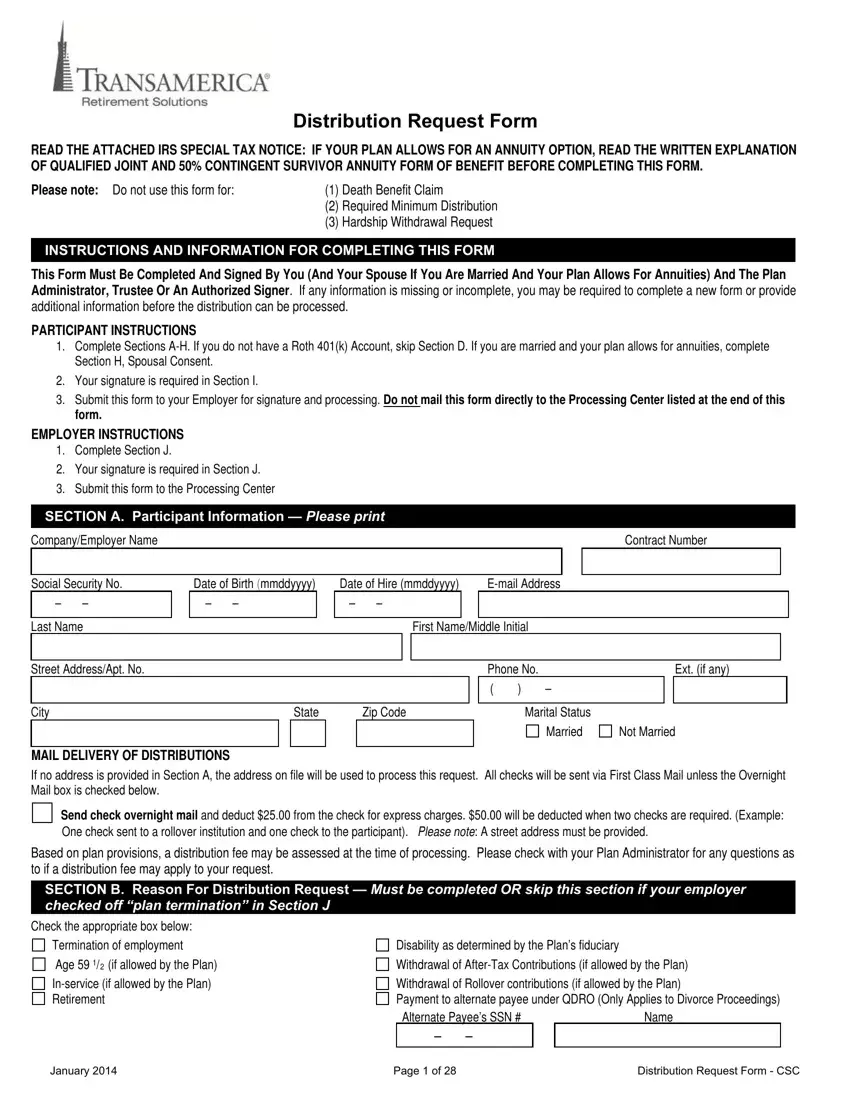

401k Distribution Request Form Fill Out Printable Pdf Forms Online

How To Roll Over Your 401 K To An Ira Smartasset

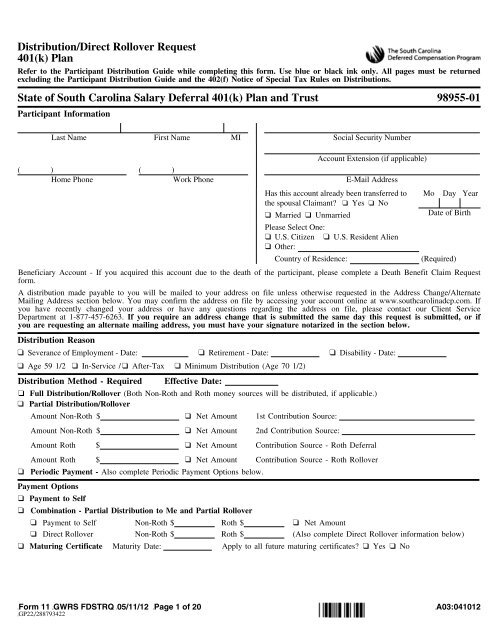

Distribution Direct Rollover Request 401 K Plan State Of Fascore

How An In Service 401 K Rollover Works Smartasset

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

Ira Rollovers And Transfers Bogleheads

Roth Non Roth Termination Form Fill Out Sign Online Dochub

The Ins And Outs Of Rollover Iras Vanguard

Gulf Coast Educators Federal Credit Union Converting Your After Tax 401 K Dollars To A Roth Ira Gulf Coast Educators Federal Credit Union

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

Transamerica 401k Withdrawal Fill Out Printable Pdf Forms Online